Midtown Finance

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.

Investing 101: Getting Started

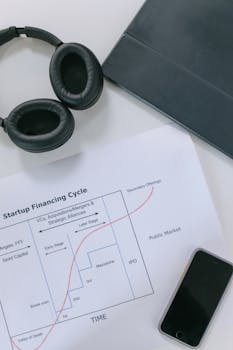

Investing is fundamentally about making your money work for you. If you’re new to this world, it can feel intimidating, but trust me, it doesn’t have to be. Start by understanding what investing means. Essentially, it’s the process of allocating resources, usually money, for profit or material results. Familiarize yourself with different asset classes—stocks, bonds, real estate, and mutual funds. Each comes with its risks and rewards.

Do your research. There are tons of resources available, from financial news websites to educational platforms, that can help you get up to speed. You don’t need an MBA to comprehend investment fundamentals; basic knowledge will go a long way. Set clear financial goals. Knowing why you’re investing—whether for retirement, a home, or education—will guide your choices.

Don’t put all your eggs in one basket. Diversification is crucial. Spreading your investments across various asset classes can mitigate risk. Consider finding a brokerage platform that matches your style—some offer easy-to-use interfaces and educational resources for beginners.

Understand that investing is not a get-rich-quick scheme. Be prepared for market fluctuations. Prices can go up and down based on a myriad of factors. Staying informed about the market trends can help you adjust your strategy if needed.

Finally, be patient. Compounding can work wonders over time. Many successful investors have a long-term perspective, realizing that growth Occurs over many years, not days or months. If you’re serious about financial freedom, adopt this mindset, and you’ll be well on your way to unlocking your financial potential.

Steps to Improve Your Credit Score

Understanding the factors that influence your credit score is crucial. Payment history accounts for 35% of your credit score. Always make payments on time to avoid negative marks. Set reminders or automate your payments, if possible. Another significant factor is credit utilization, which comprises 30% of your score. Aim to keep your utilization below 30% of your total available credit. This means if your credit limit is $10,000, your balance should remain under $3,000. Paying off your balances, instead of just the minimum, can help significantly.

Additionally, the length of your credit history matters. Keep your oldest accounts open even if you don’t use them often. Closing older accounts can negatively impact your score. A longer credit history can enhance your creditworthiness. Also, avoid applying for too much new credit at once; each hard inquiry can temporarily lower your score. It’s better to space out applications.

Regularly checking your credit report for errors is a step often overlooked. Dispute any inaccuracies immediately, as they can harm your score. Everyone is entitled to a free credit report annually from each of the three major bureaus. Make sure to take advantage of this.

Furthermore, consider diversifying your credit. If you only have credit cards, adding an installment loan may boost your score by showing you can handle different types of credit. However, only take on credit you need. Smart borrowing can enhance your profile. Consistency and patience will ultimately lead to an improved credit score.

Retirement Planning Essentials

Retirement planning is non-negotiable. It’s an integral part of achieving financial freedom that many overlook until it’s too late. I firmly believe that starting early can significantly impact your financial future. The earlier you begin saving and investing, the more time your money has to grow.

One essential element is setting a realistic savings goal. You must calculate how much money you’ll need to live comfortably during retirement, factoring in lifestyle, healthcare costs, and unexpected expenses. Being realistic about your needs can prevent unwelcome surprises down the road.

Next, take advantage of employer-sponsored retirement accounts like a 401(k). These plans often include matching contributions, which is essentially free money. Don’t leave this on the table; contribute enough to get the full match if your employer offers it.

Investing is another critical aspect. It’s crucial to diversify your investments to manage risk effectively. Stocks, bonds, and mutual funds should all be part of your investing strategy, depending on your risk tolerance and retirement timeline. Your investment choices will play a significant role in how much wealth you accumulate.

Budgeting is equally vital for retirement planning. Track your expenses and savings to identify areas where you can cut back and increase your savings rate. Living below your means now can lead to greater rewards in retirement.

Lastly, regularly review and adjust your plan. Life changes, and your financial strategies should also evolve over time to reflect new goals, changes in income, or market fluctuations. Consistency and regular updates to your plan ensure that you stay on track. Don’t let complacency derail your future.

172K Followers, 15 Following, 373 Posts – Midtown Uniform (@midtownuniform) on Instagram: "button down. vest. slacks. : #midtownuniform ✉️: dm photos to …

Midtown Uniform (@midtownuniform) • Instagram photos and videos

This website is designed to help our clients achieve their financial goals through a long-term relationship with a trusted and knowledgeable advisor.

Midtown Plaza Carmel. 6:30 AM – 9:00 AM. Coffee on the Monon · Aug. 26. Council … Site Map Contact Us Privacy Statement. Connect. ui-fb@2x · x-logo-white · ui- …

… Midtown 1. View directions from Harrisburg Campus (Google Maps); Download map … 717-780 2414. Contact Us Careers Site Map Antidiscrimination Policy …

Common Investment Mistakes

Avoid these pitfalls to enhance your financial journey.

- Ignoring Market Research: Skipping the necessary homework before investing can lead to poor choices. Always understand where you’re putting your money.

- Chasing Trends: Jumping on the latest hot stock or investment fad often results in losses. Stick to a solid strategy instead.

- Emotional Decision-Making: Allowing fear or greed to drive your actions can result in selling low or buying high. Maintain a calm demeanor to foster better results.

- Over-Diversification: Spreading your investments too thin dilutes focus and can lead to average returns. Quality over quantity is essential.

- Neglecting Fees: Investment costs can erode profits. Be mindful of fees associated with funds or advisors, as they can add up significantly over time.

- Timing the Market: Trying to predict market movements is a gamble. Consistent investing is generally more beneficial than attempting to time entry and exit points.

Tax Tips You Can’t Ignore

Effective tax planning can significantly enhance your financial potential. I can’t stress enough how essential it is to stay informed about the tax strategies available to you. Whether you’re a seasoned investor or just starting to save, these tax tips will make a huge difference in your financial journey.

First and foremost, maximizing your retirement account contributions is non-negotiable. Tax-advantaged accounts like 401(k)s and IRAs can reduce your taxable income, allowing your savings to grow tax-free or tax-deferred. Consider bumping up your contributions this year if you haven’t already.

Next, pay attention to itemized deductions. Identify expenses you can write off, such as medical costs, mortgage interest, and charitable contributions. I realize these can vary greatly, but don’t leave money on the table. The standard deduction has its perks, but if your itemized deductions exceed it, you could save a bundle.

You also need to keep track of capital gains. Short-term capital gains are taxed at your ordinary income rate, which can be steep. If possible, hold onto your investments for over a year to benefit from lower long-term capital gains rates. This simple shift can drastically reduce your tax bill.

Consider tax-loss harvesting as another clever tactic. Selling underperforming assets to offset taxes on your gains could result in significant savings. It’s a no-brainer if you want to lower your taxable income while strategically refining your portfolio.

Lastly, stay updated on any changing tax laws. Tax strategies can shift based on congress’s whims, so don’t assume last year’s methods are valid this year. Regularly consult financial blogs, news, or professionals to keep your strategy fresh and effective.

These aren’t merely suggestions but critical elements of a well-rounded financial approach. By actively implementing these tax tips, you’ll not only boost your savings but set yourself up for long-term financial success.

Understanding Financial Freedom

Financial freedom means the ability to make choices without being restrained by financial limitations. I truly believe that achieving this state requires a practical approach to money management. It’s not just about accumulating wealth; it’s about understanding your relationship with money. You must grasp that financial freedom is attainable for everyone, regardless of their current financial situation.

Investing is one method that can markedly enhance your financial lifestyle. I emphasize the importance of education in investing, as it empowers you to take control of your finances. The stock market, real estate, or diverse asset classes provide a plethora of opportunities that can advance your financial goals.

Save diligently and budget wisely. Creating a budget isn’t simply an exercise in restraints; it’s a tool that allows you to take charge of your financial future. I find that the discipline of tracking spending and identifying areas to cut back can free up resources for investing or for establishing an emergency fund. Remember, even small savings can accumulate over time.

Another critical aspect is understanding market trends. Staying updated with economic movements, interest rates, and consumer behaviors can give you a competitive edge. Many fail to realize that knowledge is power; the more you know, the better your financial choices will be. Explore various resources: books, podcasts, or even expert insights from blogs like this one.

Ultimately, financial freedom encompasses personal growth as well. Improve your skills, explore new career opportunities, or even consider side gigs to enhance your income. The more avenues of income you create, the closer you get to financial security. Remember, this journey is truly personal; what works for one may not work for another. Don’t shy away from seeking advice but remain true to your needs and goals. The path to financial freedom is within reach, and I encourage you to take actionable steps towards it.

… Midtown. Patients receiving breast surgical oncology care at the Clifton … We provide free financial counseling to help you manage the financial aspects of …

Insurance and Billing | Winship Cancer Institute of Emory University

… Midtown 1. View directions from Harrisburg Campus (Google Maps); Download map … Financial Aid, financialaid@hacc.edu. Health Careers (advising …

Emory University Hospital Midtown (EUHM) is one of the nation's leading community-based, acute care academic medical centers. The facility is a 531-bed …

Emory University Hospital Midtown | Emory School of Medicine

Key Benefits of Budgeting

Budgeting fundamentally transforms how we handle our finances. Here are some undeniable advantages I’ve experienced.

- Gives clarity on spending habits: Budgeting forces us to take a hard look at where our money is going. Knowing these details helps me make conscious choices.

- Enhances savings: By outlining our income and expenses, it becomes clear how much can be set aside for savings. This helps in creating a financial cushion.

- Reduces financial stress: Having a budget provides a sense of control. I always feel more secure knowing I have a plan.

- Prepares for emergencies: Budgeting allows us to allocate funds for unexpected costs, making it easier to weather financial storms.

- Sets clear financial goals: With a budget, we can pinpoint specific targets, whether it’s buying a house or planning a vacation.

- Encourages debt management: By prioritizing payments within a budget, we can effectively tackle and reduce debt.

Top 5 Budgeting Apps to Try

These budgeting apps have proven to be effective tools for managing finances and achieving savings goals.

- 1. Mint: I absolutely love Mint for its user-friendly interface. It automatically tracks your spending and categorizes it, which means I don’t have to input every transaction manually. I find the budgeting features incredibly helpful for staying on track.

- 2. YNAB (You Need A Budget): YNAB has completely changed my budgeting approach. It focuses on proactive budgeting and encourages me to assign every dollar a job. Its educational resources keep me motivated and engaged with my finances.

- 3. PocketGuard: PocketGuard is fantastic for understanding how much I can spend, thanks to its ‘in my pocket’ feature. It connects to my accounts and assists in tracking my bills and spending limits effortlessly.

- 4. GoodBudget: GoodBudget has a modern twist on the envelope budgeting system. I appreciate its simplicity and the ability to access my envelopes from any device. It’s an excellent choice for those who prefer a straightforward approach.

- 5. EveryDollar: Created by Dave Ramsey, EveryDollar offers a simple way for me to plan my budget using a zero-based method. I enjoy the clean layout and the ability to customize my categories, which makes budgeting feel less daunting.

The Importance of Budgeting

Budgeting is absolutely essential for anyone looking to unlock their financial potential. It acts as a financial roadmap, guiding you toward your goals while keeping unnecessary expenses at bay. Without a budget, spending can quickly spiral out of control, leading to headaches and missed opportunities. By creating a clear budget, you’re not just tracking what you earn and spend; you’re taking control of your financial destiny.

One of the most significant benefits of budgeting is the clarity it brings. You’ll gain insights into your spending habits, allowing you to identify areas for improvement. For example, if you’re mindlessly spending on subscriptions you rarely use, a budget will make that glaringly obvious. Armed with this knowledge, you can make conscious choices that reflect your priorities.

Moreover, budgeting fuels your savings and investments. When you allocate specific amounts for saving and investing, you create a strong foundation for wealth creation. This proactive approach will enable you to take advantage of opportunities like market investments, emergency funds, or even that dream vacation you’ve always wanted.

Let’s not overlook the peace of mind that accompanies a well-structured budget. Knowing that you’re in control of your finances diminishes stress and cultivates a sense of freedom. You’ll sleep better at night, knowing you’re prepared for unexpected expenses.

Ultimately, budgeting empowers you to live within your means while paving the way for a brighter financial future. There’s no denying it—if you aim to achieve financial freedom, budgeting is indispensable.

Understanding Different Investment Vehicles

Exploring investment vehicles can open doors to financial growth and opportunities.

- Stocks offer a slice of ownership in companies and can yield high returns.

- Bonds are relatively safer, providing fixed interest payments over time.

- Mutual funds pool resources, allowing investors to diversify their holdings.

- ETFs are like mutual funds but trade on exchanges, allowing for flexibility.

- Real estate can generate passive income and appreciation, making it enticing for many.

- Cryptocurrency has gained popularity for those seeking high-risk, high-reward potential.

- Commodities like gold can be a hedge against inflation and market volatility.

- Retirement accounts like 401(k)s offer tax advantages for long-term saving.

Maximizing Your Savings Potential

Maximizing your savings potential is not an abstract concept; it’s a practical goal. As someone who has navigated the complexities of managing finances, I can confidently say that understanding where every dollar goes can significantly boost your savings. Savings isn’t merely about setting aside money; it’s a strategic approach that demands awareness and discipline.

First, I urge you to scrutinize your spending habits. By tracking expenses, you might be shocked at how much you waste on subscriptions or impulse purchases. Once you identify these areas, you can cut back and redirect that money toward savings. It’s all about making conscious choices.

Next, establish a savings goal. Whether it’s a specific amount or a timeline for a larger purchase, this goal will motivate you. I suggest using high-yield savings accounts to benefit from better interest rates than traditional ones. Every dollar counts, and the compounding interest can significantly enhance your savings.

Additionally, consider automating your savings. By setting up automatic transfers from your checking to your savings account, you create a system where saving becomes effortless. No temptation to spend what you can save! Furthermore, when you receive windfalls—like bonuses or tax refunds—don’t fall into the trap of spending it all. Allocate a portion or even the entire amount toward your savings. This strategy ensures you benefit from unexpected gains.

Lastly, stay informed about market trends regarding savings accounts and interest rates. Financial institutions regularly adapt their offerings based on economic conditions, and taking advantage of these changes can maximize your potential returns. Knowledge is power; the more you know, the better your financial decisions will be.

Navigating Insurance Options

Finding the right insurance plan can significantly impact your financial well-being. I believe that understanding your insurance options is crucial; it’s a step toward securing your future against unforeseen events. Whether it’s health, auto, home, or life insurance, knowing what to look for can save you a considerable amount of money and stress in the long run.

First, prioritize what you need most. Health insurance should be a primary focus since medical costs can be exorbitant. Make sure to consider factors like premiums, deductibles, and co-pays. Look for plans that provide comprehensive coverage at reasonable costs. Remember, the cheapest option may not always be the best choice.

Next, explore auto insurance policies. Take the time to compare rates and coverage options. Many insurers offer discounts for safe driving, bundling policies, or being a good student. It pays to shop around—don’t settle for the first quote you receive!

Home insurance is another area where many people don’t pay enough attention. Ensure you’re protecting not just your property but also your assets. Consider the type of coverage you need—actual cash value or replacement cost. Being underinsured can lead to financial disaster if disaster strikes.

Lastly, life insurance can seem daunting, but it’s essential for anyone with dependents. Evaluate your needs based on factors like your debts, income, and family situation. Term life can be a more affordable option than whole life, but make sure you understand the details of the policy you choose.

Don’t forget to read the fine print! Policies can have exclusions or limitations that significantly affect your coverage. As you assess your options, ask questions and seek clarification on anything unclear. Taking control of your insurance choices not only protects you but also opens up potential savings.

Ultimately, investing the time to understand your insurance options can contribute to your overall financial strategy. Approach it with diligence, and you’ll find peace of mind knowing you’re adequately protected.

Decoding Market Trends

Understanding market trends is essential for anyone serious about unlocking their financial potential. The ability to read these trends can significantly impact your investment choices, savings plan, and budgeting strategies. Markets don’t exist in a vacuum; they are influenced by a multitude of factors including economic indicators, political developments, and consumer behavior. Recognizing patterns in these elements is crucial for actionable insights. As I follow the market, I’ve learned that the key to mastering trends is vigilance. Markets can shift quickly; what seems like a strong upward trajectory one day can plummet the next. Being proactive rather than reactive is vital. For instance, if a particular sector is experiencing a surge due to technological advancements, it makes sense to explore investment opportunities there, while remaining wary of potential volatility. Utilizing data analytics tools can also enhance your understanding. These tools reveal essential metrics that can indicate where the market might head next. The smart investor knows that relying solely on instinct without data is a risky gamble. Moreover, keeping an eye on global influences can’t be overstated. For instance, geopolitical tensions can send shockwaves through markets, making it crucial to stay updated on world events that may affect your financial strategy. Awareness of both local and international factors will sharpen your market acumen. In the end, your success in the market is a blend of intuition, meticulous analysis, and timely action. The financial landscape rewards those who can decode and predict trends effectively. Comprehensive financial advice from experts can also provide clarity and strategy to help you navigate complexities. Understanding market trends is your first step toward financial freedom.

Smart Debt Management Strategies

Effective debt management is crucial for unlocking your financial potential. I’ve seen firsthand how a strategic approach to debt can pave the way for financial freedom. First off, I can’t stress enough the importance of understanding your debt. List out all your debts, their interest rates, and monthly payments. This straightforward step gives clarity and sets the stage for effective management.

Next, prioritize your debts. Concentrate on those with the highest interest rates—this is commonly referred to as the avalanche method. By targeting high-interest debts, you can save more money in the long run. Alternatively, some prefer the snowball method, where you tackle the smallest debts first to gain momentum. Choose a strategy that resonates with you.

Consistency is key. I recommend setting up automatic payments for your debts. This way, you avoid missing payments and incurring unnecessary fees. Additionally, consider negotiating lower interest rates with your creditors. Many are willing to work with you, especially if you’ve been a timely payer.

Exploring refinancing options can also be a game changer. If you can secure a lower interest rate through a personal loan or a credit card balance transfer, seize that opportunity. Debt consolidation can simplify your payments and often reduce the total interest paid. Always be cautious, though; don’t fall into the trap of accumulating more debt while trying to manage existing obligations.

Lastly, education is empowering. Regularly update yourself on financial trends and debt management techniques. Engaging in financial literacy can provide insights that help you make better choices. Remember, managing debt smartly is about proactive engagement rather than passive waiting. Taking control of your financial situation isn’t just a step; it’s a leap towards real freedom.

Building an Emergency Fund

An emergency fund is the backbone of financial security. It’s not optional; it’s essential. Life throws unexpected events our way—job loss, medical emergencies, urgent house repairs. I know firsthand how unsettling these surprises can be, and that’s why I emphasize the need for a dedicated emergency fund.

The goal is to save three to six months’ worth of living expenses. You can start small, perhaps with just a few hundred dollars, then work your way up. What matters is consistency. Set up an automatic transfer to your savings account each payday. By making it automatic, you won’t even miss the money. Trust me, this will make building your fund much easier.

Where should you keep your emergency fund? Look for a high-yield savings account. You want a safe, accessible place for your cash, with minimal risk of loss. Steer clear of stock markets for this money; it should be safe and liquid.

Don’t let lifestyle inflation derail your plans. As your income increases, resist the urge to inflate your expenses. Instead, channel that extra cash into your emergency fund. This approach builds financial resilience like nothing else.

Finally, remember that your emergency fund isn’t just a number to reach—it’s a shield against financial stress. Having one in place allows you greater freedom to pursue other financial goals, like investing or starting a business, because you know you’re protected. Build your fund, and unlock your financial potential.

What is the best way to start budgeting?

Getting serious about budgeting is essential for financial freedom. I recommend starting with tracking your income and expenses meticulously. Use a simple spreadsheet or a budgeting app to record every dollar that comes in and every dollar spent. Next, categorize your expenses into needs, wants, and savings. This distinction will shine a light on where you can cut back. Don’t shy away from making tough choices. If dining out is draining too much from your monthly budget, it’s time to reflect on that habit. Setting specific financial goals adds motivation—whether it’s saving for a vacation or paying off debt. Creating a realistic monthly budget based on your actual expenses will provide clarity. Review your budget regularly to adjust for any changes in your income or lifestyle. Remember, the right budgeting strategy should feel empowering. Acknowledge that you’re taking control of your finances. This commitment to budgeting will pave the way for smarter spending and enhanced saving.

How much should I save for an emergency fund?

Generally, I recommend saving three to six months’ worth of living expenses. This amount provides a reasonable cushion against unexpected financial setbacks like medical emergencies or job loss. When determining the exact figure, consider your personal circumstances. If you have dependents or work in a volatile industry, you might need to aim for the higher end of that spectrum.

Don’t underestimate the importance of this fund. It’s your safety net, your security blanket in uncertain times. I personally believe that having an emergency fund is non-negotiable; it lets you approach financial planning with confidence. Start by assessing your monthly expenses to identify how much you realistically need to save. Prioritize building this fund before making significant investments to ensure you’re not caught off guard by life’s surprises.

Ultimately, saving aggressively for your emergency fund is a proactive strategy that can make all the difference in achieving financial stability and freedom.

How can I improve my credit score quickly?

Improving your credit score isn’t a time-consuming process, but it does require focused efforts. Start by paying down existing debts. High credit utilization can damage your score, so aim for a utilization ratio below 30%. Next, make sure all your bills are paid on time; even one missed payment can hurt you significantly. Consider becoming an authorized user on someone’s established credit card. If they have a solid payment history, their positive credit behavior will benefit you. Additionally, check your credit report for errors and dispute any inaccuracies promptly. You might be surprised by how much a simple error can drag down your score. Lastly, limit new credit inquiries. Too many applications in a short period can be seen as risky behavior by lenders. Implementing these strategies can lead to noticeable improvements in your credit score within just a few months. Remember, consistency is key!

What are the risks of investing in the stock market?

Investing in the stock market comes with significant risks that every potential investor should understand. First off, market volatility can lead to sudden losses. Prices can fluctuate dramatically due to economic events, political instability, or even market sentiment. It’s crucial to accept that you could lose a substantial portion of your capital as the market reacts to unforeseen circumstances.

Furthermore, individual stocks can underperform for reasons beyond your control. A company can experience issues such as poor management or unexpected competition, which could tank its stock value. Diversification helps mitigate this risk but doesn’t eliminate it.

Another pressing risk is the psychological aspect of investing. Fear and greed can drive poor decision-making, leading you to sell at a loss or miss out on gains. Staying disciplined and having a clear investment strategy is vital. Finally, don’t overlook the potential for fraud and scams, especially in an online world where misinformation is rampant.

Understanding these risks doesn’t mean avoiding the stock market altogether; it means being genuinely prepared for what lies ahead.

What is compound interest and why is it important?

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. This means the money you earn doesn’t just sit there; it grows exponentially over time. If you want to build wealth, understanding compound interest is crucial. I can’t stress enough how it can work in your favor if you start saving or investing early. The earlier you start, the more time your money has to grow. For instance, investing $1,000 at a 5% annual interest rate over 20 years can yield over $3,200 simply through compounding.This powerful effect is often referred to as “the miracle of compounding.” The longer you allow your investments to grow, the more significant your returns will be. This principle not only applies to savings accounts but also to investment portfolios and retirement funds. So, if you’re serious about achieving financial freedom, you must harness the power of compound interest. It can dramatically enhance your financial potential, enabling you to make your money work for you rather than the other way around.

When should I start planning for retirement?

Start planning for retirement as early as you can. The truth is, the sooner you begin, the better off you’ll be. Compound interest works wonders over time, so delaying your contributions can significantly impact your future savings. There’s no age too young to begin considering your retirement strategy. Whether you’re in your 20s or 30s, developing a financial plan will set the groundwork for a secure future. Assuming you’ll figure it out later is a disservice to your financial wellbeing. Creating a budget now that includes retirement savings is crucial. Once you hit your 40s, you should have a solid plan in place and be aggressively saving if you haven’t done so already. Ultimately, planning for retirement isn’t a one-time event but a lifelong process. Regularly review and adjust your plans based on life changes and market conditions to ensure your retirement vision becomes a reality.

Achieving financial independence demands regular commitment and a solid understanding of money management. I firmly believe that without these, the dream of financial freedom remains elusive. You must actively educate yourself and make steady progress to unlock your true financial potential. Your path to success starts with your effort and knowledge.

Budgeting is non-negotiable for anyone serious about their financial future. I’ve seen firsthand how a well-structured budget transforms anxiety into control. With every dollar accounted for, I’m empowered to invest, save, and spend wisely. If you’re not budgeting, you’re relinquishing your financial freedom.

Investing early can lead to significant wealth accumulation. I’ve seen firsthand how starting sooner rather than later can multiply your returns exponentially. Time is your ally in compounding interest, and each dollar invested today paves the way for a more secure financial future. Don’t wait—your future self will thank you.

Understanding market trends is essential for making wise investment choices. By analyzing current data and patterns, I’ve seen firsthand how these trends directly impact my portfolio. Ignoring them could mean missing valuable opportunities. Embracing this knowledge not only boosts my confidence but also enhances my financial strategy. That’s how I unlock my financial potential.

Having an emergency fund is essential for safeguarding your financial stability. Unexpected expenses can arise without warning—car repairs, medical bills, and more can throw you off balance. By setting aside funds specifically for emergencies, you shield yourself from financial stress and reliance on credit. This not only provides peace of mind but also helps maintain your financial momentum.

**A better credit score is your ticket to financial freedom.** With it, I can access lower loan rates, higher credit limits, and better insurance premiums. **Each point increase can significantly change the offers available to me.** I can’t stress enough how vital it is to take control of my credit now for future benefits.

Stagnation is the enemy of financial success. I firmly believe that taking the time to assess your financial goals regularly keeps your strategy aligned with your evolving needs. Markets shift, personal circumstances change, and your objectives may need adjustments. Evaluating your progress ensures you’re on track for financial freedom.

Tax planning is crucial for maximizing your wealth. By strategically organizing your finances, you can significantly reduce your tax liability and increase your savings. It’s empowering to see how effective tax strategies allow money to work for you rather than against you. Don’t underestimate the impact proper planning can have on your financial future.

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.