A Practical Guide To Quantitative Finance Interviews Pdf

Understanding Quantitative Finance

Quantitative finance combines mathematical models with financial theory to help us understand and predict market behaviors. This field captivates me, as it transforms abstract concepts into actionable strategies. I find the elegance in using statistics and algorithms to dissect market patterns. By leveraging quantitative methods, we can develop insights that greatly enhance our financial decision-making. It’s not just a matter of guessing trends; we are equipped with data-driven approaches that can significantly minimize risks and maximize returns.

One aspect I love about quantitative finance is its reliance on empirical data. We assess historical price movements, scrutinize trading volumes, and analyze volatility to create models that forecast future movements. These analyses are crucial for anyone looking to engage seriously in investing or trading. They aren’t mere theories; they represent practical methods to achieve financial goals.

Moreover, understanding this field empowers us to interpret financial instruments like options, futures, and derivatives more effectively. Each of these tools carries its own risk and reward profile, which a quantitative approach can illuminate. This understanding allows us to implement sophisticated strategies that go beyond basic investment tactics.

Adapting to market changes is essential, and quantitative finance offers various strategies to recalibrate our approaches. Whether it’s adjusting a portfolio in response to new economic data or implementing algorithmic trading strategies, the tools at our disposal are versatile. I appreciate this flexibility as it allows us to stay responsive in a fast-paced environment.

Finally, I encourage everyone to take an interest in this subject. The lessons from quantitative finance are invaluable for anyone wanting to unlock financial potential. With the right insights, we can make confident strides toward financial freedom.

The website is a joint venture with my editor, Brett Jiu. You will also find some extra interview problems with answers that we have gathered. I sincerely hope …

Security · Insights. Files. master. Breadcrumbs. datasciencecoursera. /. [Xinfeng Zhou]A practical Guide to quantitative finance interviews.pdf. Latest commit …

datasciencecoursera/[Xinfeng Zhou]A practical Guide to quantitative …

Jul 3, 2022 … • 2y ago. I assume this is green book: A Practical Guide To Quantitative Finance Interviews https://a.co/d/aYtMN2a. Upvote 6. Downvote Reply …

Trying to complete every problem in green book before interview …

Jan 31, 2022 … A Practical Guide To Quantitative Finance Interviews by Xinfeng Zhou … This site uses cookies to help personalise content, tailor your …

Essential Skills for Quantitative Finance Interviews

Securing a position in quantitative finance is no easy feat. The interview process is rigorous, and candidates must present a diverse skill set. Strong analytical skills are critical; being able to dissect complex datasets is a key expectation. Proficiency in programming languages like Python, R, or C++ is often non-negotiable. Without coding expertise, your chances of standing out diminish significantly. Additionally, understanding statistical analysis and probability theory cannot be overlooked—grasping these concepts will set you apart in theoretical discussions.

Another essential skill is problem-solving. Interviewers will often present real-world problems to assess your analytical thinking and creativity. Practicing under pressure can significantly enhance your capabilities. You should be ready to apply mathematical models to financial problems, showing how you can translate theory into practice.

Communication skills are equally important. Being able to convey complex ideas in a straightforward manner is crucial. You might be working with a team that includes non-technical members, so clarity in your explanations makes a positive impact.

Your understanding of financial markets and instruments must also be sharp. A deep knowledge of derivatives, equities, and fixed income shows that you take the field seriously. Familiarizing yourself with current market trends helps you answer questions with context and relevance.

Lastly, don’t underestimate the role of soft skills. Teamwork, adaptability, and a proactive mindset can set you apart from technically proficient candidates. Employers are looking for individuals who can thrive in dynamic settings. By focusing on these essential skills, you can position yourself as a competitive candidate in quantitative finance.

Mock Interviews: Why They Matter

Mock interviews are critical tools for anyone looking to advance their career. They provide a safe environment to practice and refine your communication skills, boosting your confidence before the real deal. In my experience, the feedback received during mock interviews is invaluable. It’s not just about answering questions; it’s about understanding how to present yourself effectively and to engage with the interviewer. Even the most qualified candidate can falter without proper interview preparation. You can have the best resume, but if you can’t articulate your experience and skills convincingly, you risk losing opportunities. Mock interviews help you identify areas for improvement. Whether it’s your body language, articulation, or the way you handle tough questions, constructive criticism will allow you to grow. Practicing with others or even in front of a mirror can unveil habits you might not even realize you have. You also get a feel for the pressure of the actual interview situation. The more you simulate it, the more prepared you’ll be to handle nerves on the big day. By putting yourself in that seat multiple times, you learn to manage anxiety and maintain your composure. In an age where competition is fierce, standing out from the crowd is essential. Fine-tuning your interviewing skills can set you apart from peers who may underestimate the significance of preparation. Ultimately, mock interviews empower you to step into your next interview with poise and clarity.

Top companies hiring quant professionals

These industries are on the lookout for quant experts to tackle complex financial challenges and drive data-driven insights.

- J.P. Morgan: A powerhouse in finance, they consistently seek sharp minds to analyze vast datasets and craft innovative financial solutions.

- Goldman Sachs: Known for its competitive environment, Goldman offers quant roles that involve sophisticated modeling and analytics to support trading and investment strategies.

- Citadel: This firm actively recruits quants to enhance their cutting-edge trading algorithms, bringing quantitative analysis to the forefront of their operations.

- AQR Capital Management: A leader in quantitative investing, AQR values professionals who can apply statistical techniques to manage risk and optimize returns.

- D.E. Shaw Group: This tech-driven investment firm places a premium on quantitative talent, utilizing mathematical models for rigorous financial analysis and decision-making.

Mar 27, 2019 … • Guide to Financial Markets, The Economist, 6th Edition (Free PDF … A Practical Guide to Quantitative Finance Interviews, Xinfeng Zhou, 2008.

Brain Teasers A Practical Guide To Quantitative Finance Interviews If two people in this group met each other, you and the pair (3 people) met each other.

(PDF) [Xinfeng Zhou] A Practical Guide To Quantitative F(Book Fi …

from Wall Street Job Interviews by Timothy · Crack. A Practical Guide to Quantitative Finance · Interviews by Xinfeng Zhou. Cracking the Finance Quant …

Preparation plan and prerequisites Math (all required) Calculus …

Real-Life Case Studies in Quantitative Finance

Real-life case studies in quantitative finance illuminate the practical applications of complex theories and strategies. One captivating example involves the use of statistical arbitrage by a hedge fund manager. By leveraging mathematical models, this manager identified mispricings in stock pairs—effectively betting on the convergence of their prices. His disciplined approach brought substantial returns, showcasing the power of quantitative methods in generating alpha.

Another vivid case study revolves around the Black-Scholes model, primarily used for pricing options. A financial institution applied this model to hedge their portfolio against potential market volatility. Through meticulous analysis and real-time data adjustments, they managed to minimize losses while maximizing their exposure to profitable trades. This real-world application exemplifies how theoretical frameworks can be effectively translated into practical strategies.

Additionally, the rise of algorithmic trading has transformed market dynamics. One notable firm executed trades based on complex algorithms that evaluated massive data sets in milliseconds. Their system not only enhanced execution speed but also improved the accuracy of predictions. By employing quantitative models, they outperformed traditional traders significantly.

Each of these scenarios serves as a testament to how quantitative finance transcends theoretical borders to impact actual market performance. These case studies can inspire both budding and seasoned investors, demonstrating the tangible benefits of incorporating quantitative strategies into their financial arsenal.

Building Your Portfolio: Key Strategies

Building a strong investment portfolio requires **focus and strategy**. First off, **diversification is crucial**. Spreading your investments across various asset classes minimizes risk and can enhance returns. By investing in stocks, bonds, real estate, and even commodities, you safeguard your financial wellbeing against market volatility. It’s essential to know that not all assets perform the same under economic conditions.

Another significant aspect is to **stay informed about market trends**. Regularly tracking the performance of your investments allows you to make adjustments as needed. I find that subscribing to financial news outlets, attending webinars, and following market analysts on social media can provide valuable insights.

Additionally, consider your time horizon. **Long-term investments, like retirement accounts, benefit from compound interest**, while short-term goals may require more liquid assets. Understand the purpose of each investment and plan accordingly.

Rebalancing your portfolio at least annually should be a priority. **Market movements can skew your initial allocation**, leading to potential risks. By regularly reassessing your portfolio, you ensure it aligns with your investment goals and risk tolerance.

Lastly, don’t underestimate the value of **consistent contributions**. Setting up automatic transfers to your investment accounts helps build wealth over time without the temptation to spend that money elsewhere. **Compounding will work its magic** if you commit to this strategy.

These key strategies, coupled with discipline and a proactive mindset, will undoubtedly help you build a portfolio that aligns with your financial aspirations.

Resources for Further Learning

To truly unlock your financial potential, it’s essential to engage with a variety of resources that deepen your understanding. Here are some of the resources I find invaluable:

Books: Reading authoritative books on finance can offer profound insights. Titles like “The Intelligent Investor” by Benjamin Graham or “Rich Dad Poor Dad” by Robert Kiyosaki provide different perspectives on investing and wealth building.

Podcasts: I recommend tuning into podcasts such as “The Dave Ramsey Show” for personal finance advice or “Invest Like the Best” for investment strategies. These podcasts provide expert viewpoints and often tackle contemporary financial topics that can expedite your learning.

Webinars and Online Courses: Consider enrolling in online courses on platforms like Coursera or Udemy. They offer structured learning on budgeting, investing, and financial planning. Certain institutions even provide free resources, which can be incredibly beneficial.

Online Forums and Communities: Engage with communities like Reddit’s r/personalfinance or Bogleheads. Here, you can ask questions, share experiences, and gain different viewpoints that are often overlooked.

Financial News Websites: Websites like Bloomberg, CNBC, and MarketWatch keep you updated on the latest market trends. Staying informed through these platforms can equip you with the knowledge to make better decisions in your financial endeavors.

By utilizing these resources, you’ll find a wealth of information that can propel you toward financial freedom. The key is consistency; make time to learn regularly and apply what you discover. Knowledge is power, especially in finance.

Common Types of Quantitative Finance Questions

Quantitative finance is not just an academic exercise; it’s a crucial part of real-world financial strategies. Below are some prevalent questions I encounter in this field, which can help illuminate your financial potential.

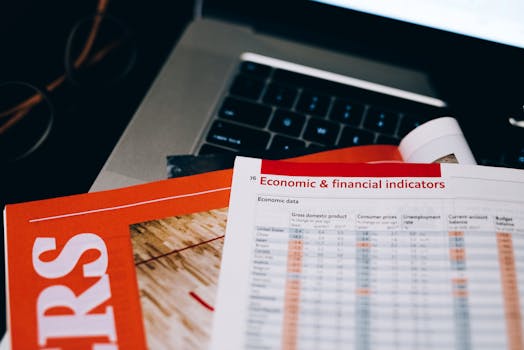

First, many people ask about pricing models. How do we value options and financial derivatives? The Black-Scholes model is often the go-to. It’s fascinating how mathematical equations can influence market behavior and investment strategies. Understanding these models can significantly inform your investment choices.

Another common question revolves around risk management. How do we assess and mitigate financial risks? Tools like Value at Risk (VaR) have emerged as standards in financial institutions for measuring potential losses. Grasping these concepts allows investors to better protect their assets.

Portfolio optimization is yet another topic that consistently comes up. How do we balance risk and return in our investment portfolios? Techniques such as Modern Portfolio Theory provide concrete strategies for achieving an optimal asset mix. Knowing how to apply these theories can set you apart from other investors.

Statistical analysis is crucial in this field too. Questions like, how do we use historical data to forecast future performance? Many individuals overlook the importance of thorough data analysis in making sound investment decisions. By employing tools like regression analysis, you can uncover trends that directly impact your financial strategies.

An often-asked question involves high-frequency trading (HFT). What algorithms are used to execute trades at lightning speed? HFT has transformed the market landscape, and understanding its mechanics can help investors adapt to new market realities.

Ultimately, these questions aren’t just academic; they serve practical and actionable purposes for anyone interested in enhancing their financial acumen. By exploring these common inquiries, you set yourself up for success in the increasingly complex world of finance.

Preparing for Behavioral Interview Questions

Preparing for behavioral interview questions is a crucial step in the hiring process. These questions are designed to assess how you’ve handled various situations in the past, which can be a strong indicator of how you’ll perform in the future. The key is to reflect on your experiences and articulate them clearly in the interview.

Start by identifying relevant experiences that showcase your skills, adaptability, and problem-solving abilities. Think about times you’ve succeeded in stressful situations or when you’ve had to work as part of a team. Use the STAR method (Situation, Task, Action, Result) to structure your responses. This method helps you present your story in a clear and compelling way.

Practice is essential. Mock interviews with friends or mentors can help you refine your answers and build confidence. Don’t underestimate the power of feedback; it can significantly improve how you convey your experiences.

Be honest and authentic in your responses. Employers value integrity, and your genuine experiences are more impactful than a rehearsed answer. Adapting your story to align with the job you’re applying for can help demonstrate both your qualifications and enthusiasm for the position.

Lastly, prepare for follow-up questions. Interviewers often want to dig deeper into your stories to gauge your thought process and emotional intelligence. Being ready for these can make you stand out among other candidates. Evaluate your past adequately, practice consistently, and approach the interview with confidence. This preparation can significantly affect your chances of success.

Programming Skills You Should Hone

In today’s tech-driven world, enhancing your programming skills is essential for unlocking various financial opportunities. Being adept in coding can significantly increase your earning potential and open doors to new career paths. Whether you aim to become a software developer, data analyst, or financial modeler, the right programming skills can set you apart.

First, mastering Python should be a priority. Its versatility and extensive libraries make it invaluable for financial analysis, automation, and machine learning. Learning Python can help you interpret large datasets and even build algorithms to maximize your investment strategies.

Next on the list is SQL. Understanding SQL allows you to manage and manipulate databases, an indispensable skill in today’s data-centric environment. Being able to extract and analyze data efficiently can give you the upper hand in any financial decision-making process.

JavaScript is another crucial language to consider. It’s not just for web development; your ability to create interactive financial applications or dashboards can set you apart in any finance-related role. This skill can also give you immediate insights into your budgeting and saving practices by customizing tools to track your financial performance.

Excel programming through VBA (Visual Basic for Applications) should not be overlooked. It enhances Excel’s functionality, allowing you to automate repetitive tasks and create complex financial models. Mastering VBA can significantly save you time, making your budgeting and forecasting much more efficient.

Finally, understanding the basics of machine learning can be transformative. As data becomes more integral to finance, being equipped with machine learning skills can significantly boost your ability to predict market trends and make data-driven financial choices. The demand for these skills is rising, and getting ahead now could secure your future in the financial sector.

Investing time in these programming skills not only enhances your technical prowess but also directly contributes to your financial growth. Embrace the opportunity to learn and sharpen your skills—you won’t regret it.

Latest trends in quantitative finance

Explore the most significant shifts in quantitative finance that can influence your investment strategies and financial decisions.

- Artificial Intelligence is redefining algorithmic trading, offering significant speed and accuracy improvements.

- Big Data analytics is now essential, with firms leveraging massive datasets for predictive modeling.

- The rise of decentralized finance (DeFi) platforms is changing the landscape of investment opportunities.

- Machine learning techniques are increasingly incorporated into risk management, allowing for more precise evaluation.

- Sustainable investing is gaining traction, impacting quantitative investment strategies profoundly.

- The use of alternative data sources is becoming a standard practice, helping analysts generate unique insights.

- Quantitative finance is seeing a push for transparency, with regulations mandating clearer methodologies.

- More investment firms are adopting a multi-strategy approach, diversifying risks while optimizing returns.

Key differences between traditional finance and quantitative finance

Understanding the distinctions between traditional finance and quantitative finance helps illuminate the diverse strategies in financial markets.

- Traditional finance relies on fundamental analysis, such as company performance and economic factors, while quantitative finance focuses on mathematical models and algorithms.

- Decision-making in traditional finance often involves intuition and behavioral analysis, whereas quantitative finance emphasizes data-driven approaches.

- Investors in traditional finance may prioritize long-term relationships and networking, while quantitative finance practitioners typically engage in high-frequency trading and automated strategies.

- Risk management in traditional finance is often more subjective, dependent on personal judgment, while quantitative finance utilizes statistical methods to identify and mitigate risks.

- Traditional finance tends to focus on qualitative insights, whereas quantitative finance is heavily reliant on numerical data and complex calculations.

Networking Tips for Aspiring Quants

Networking is crucial for anyone looking to break into quantitative finance. It’s not solely about what you know; it’s about who you know and how you can leverage those connections. Here are some key strategies I have personally found invaluable.

First, attend industry conferences and seminars. These events are goldmines for connecting with industry veterans and like-minded peers. Make sure to ask questions and engage in discussions; showing genuine interest can leave a lasting impression.

Leverage online platforms like LinkedIn. Reach out to professionals in your target firms, and don’t hesitate to send them personalized connection requests. A well-crafted message that highlights your interest in their work can open doors.

Join finance-related groups and forums. Engaging in communities, whether online or offline, provides opportunities to share knowledge and expand your network. You might even come across someone who can be your mentor.

Offering your skills can also be an effective networking tool. Consider collaborating on projects or research. When you bring value to a relationship, it makes you memorable. Always be on the lookout for opportunities to assist others.

Follow up with your contacts. After meeting someone, send a quick message expressing your appreciation for the conversation. Keeping the lines of communication open fosters long-term relationships.

Lastly, be authentic. People can sense insincerity. Being yourself creates a connection that can be more valuable than any formal introduction. Your approach will help you build a network of supportive and trustworthy contacts.

Mathematical Concepts to Review for Interviews

Mastering mathematical concepts can significantly enhance your financial acumen. Let’s highlight the essential areas you should brush up on for interviews in finance or investment roles. Understanding basic arithmetic is non-negotiable. Addition, subtraction, multiplication, and division are the foundational tools necessary for analyzing financial statements and budgeting accurately.

Next, review percentages and ratios. These concepts are crucial for evaluating profit margins and return on investment (ROI). For instance, being able to quickly calculate percentage changes in revenue can set you apart from other candidates.

Don’t neglect algebra. While it may seem abstract, investing often involves solving equations to determine the present and future values of investments. Understanding terms like net present value or internal rate of return will be advantageous.

Statistics also play a significant role in finance. Grasping concepts such as mean, median, and standard deviation allows for better risk assessment. Many financial roles require analysis of historical data to forecast future trends, making statistical knowledge invaluable.

Lastly, familiarize yourself with compound interest and time value of money. These concepts are fundamental in understanding investment growth over time. A sound grasp of these principles can demonstrate your ability to think long-term in financial planning. Preparing for interviews isn’t solely about technical skills; it’s about showcasing your analytical thinking and problem-solving capabilities through these mathematical tools.

Comparison of Quantitative Roles and Required Skills

This table compares different quantitative roles related to finance, highlighting the essential skills needed for each position to help readers navigate their career paths in the financial field:

| Role | Key Responsibilities | Required Skills |

|---|---|---|

| Quantitative Analyst | Develops complex models to assess risk and generate investment strategies. | Strong mathematical background, programming skills (Python, R), and risk management knowledge. |

| Data Scientist | Analyzes large datasets to extract insights that drive business decisions. | Statistical analysis, machine learning, data visualization, and advanced coding skills. |

| Financial Engineer | Designs financial products and solutions using quantitative techniques. | Expertise in derivatives pricing, programming, and a deep understanding of financial theories. |

| Risk Analyst | Evaluates potential financial risks and creates strategies to mitigate them. | Analytical skills, knowledge of regulations, modeling skills, and impact assessment. |

| Portfolio Manager | Manages investment portfolios to achieve long-term financial goals. | Investment analysis, market knowledge, strategic thinking, and risk assessment. |

Final Thoughts on Interview Preparation

Interview preparation is a critical step towards unlocking your financial potential. Every opportunity to engage with potential employers is not just about showcasing your skills; it’s a platform for you to reinforce your financial acumen. I believe that the effort you put into preparing for interviews can significantly impact your future financial stability and growth.

First, I always stress the importance of researching the company. Understanding their financial health and market position will empower you to answer questions with confidence and insight. This knowledge can set you apart from other candidates, displaying not just your qualifications but also your genuine interest.

Practicing common interview questions allows you to articulate your thoughts clearly. I often recommend that friends and colleagues prepare answers that reflect their personal experiences related to finance. This can include discussing budgeting strategies, investment decisions, or how they’ve handled a financial setback. A well-rounded narrative can captivate interviewers and communicate your financial wisdom effectively.

Beyond answering questions, be prepared to ask your own. Demonstrating curiosity about the company’s financial goals or their approach to market trends can reveal your strategic mindset. Moreover, it shows that you are not just focused on the interviewee’s perspective but also on contributing to the company’s success.

Lastly, follow-up is crucial. Sending a thank-you note where you emphasize something discussed during the interview reinforces your interest and can keep you top of mind. These seemingly simple gestures can have a profound impact on their final decision and your professional trajectory. With this preparation, you not only enhance your interview prowess but also take a significant step towards financial freedom.

What should I study for a quantitative finance interview?

To excel in a quantitative finance interview, I recommend focusing on key areas like probability, statistics, and stochastic calculus. Mastery in these subjects lays a solid foundation for many finance problems. Algorithms and data structures cannot be overlooked; they are critical for quantitative analysis and modeling. Knowing how to analyze real financial data using tools such as Python or R puts you ahead.

Understanding financial instruments and their pricing models is crucial. Familiarize yourself with concepts like the Black-Scholes model and options pricing. Additionally, be ready to tackle brain teasers or logic puzzles; these often test your problem-solving skills under pressure. Finally, don’t underestimate the importance of current market trends and how they affect models and strategies you’re discussing. Preparation for these interviews is not about rote memorization; it requires a strategic approach to understanding the interplay between quantitative methods and financial principles.

How important is coding in quantitative finance roles?

Coding is absolutely crucial in quantitative finance roles. It’s not just a side skill; it’s the foundation for analysis and strategy in this field. Quantitative finance relies heavily on algorithms to analyze vast amounts of data. Without coding proficiency, you limit your ability to develop models that can project trends and assess risks accurately. I find that knowledge of programming languages like Python, R, or C++ isn’t optional; it’s essential for success.

Moreover, coding fosters efficiency in handling data, backtesting strategies, and automating trading processes. The ability to write clean code allows you to implement complex strategies without relying on external tools, thus giving you a competitive edge. If you’re venturing into quantitative finance, invest the time to sharpen your coding skills. You’ll thank yourself when you’re able to interpret data rapidly and make astute predictions instead of being mired in manual processes.

Can I find resources to practice quantitative finance questions?

Absolutely! There are numerous resources available for anyone interested in quantitative finance. I find online platforms and forums to be incredibly beneficial. Websites like Quantitative Finance Stack Exchange and specialized Reddit communities are great for engaging with fellow learners and professionals. You can also explore online courses on platforms like Coursera and Udemy specifically focused on quantitative finance topics. Practice questions and sample assessments are available in abundance, and utilizing these will sharpen your skills effectively. Additionally, academic institutions often share course materials and problem sets online; some are surprisingly accessible. Whether you’re looking at financial modeling or statistical analysis, committing to regular practice through these resources will bolster your confidence and competence in the field. Make use of these tools to build your expertise!

What are behavioral questions like in quant interviews?

Behavioral questions in quant interviews focus on how you approach problem-solving and teamwork. They aren’t just about your technical skills; they’re about your thought process. I often found that these questions explore past experiences to gauge your adaptability and resilience. Expect inquiries like, ‘Tell me about a time you faced a challenge and how you handled it.’ Your answers need to reflect both analytical thinking and interpersonal skills. It’s important to articulate your experiences clearly, showcasing your analytical mindset. Remember, quant firms look for candidates who can not only solve complex problems but can also work collaboratively in high-pressure situations. Be prepared with specific examples that highlight your quantitative abilities alongside your communication skills. Ultimately, your story should convey not only what you did but why it mattered and what you learned.

What type of mathematical background is ideal?

A solid mathematical foundation is crucial for anyone looking to take control of their finances. You don’t need a degree in advanced calculus, but familiarity with basic concepts like percentages, ratios, and averages is essential. Understanding these fundamentals will enable you to analyze interest rates, calculate returns on investments, and comprehend budgeting strategies effectively.

Moreover, comfort with data interpretation and simple statistical concepts will significantly benefit your financial decisions. Recognizing trends and understanding risk return profiles cannot be overstated. While you can learn these skills on the go, having a background in mathematics gives you a head start.

In short, the ideal background blends basic math skills with a curiosity to learn and apply financial principles. It’s about enhancing your ability to make sense of market trends and personal finance without feeling daunted or overwhelmed.

What are the common mistakes to avoid in interviews?

One of the biggest mistakes candidates make is failing to prepare. Research the company and the role you’re applying for. This shows genuine interest and helps you answer questions more effectively. Another error is talking too much or not enough. Practice concise, clear answers that convey your points without rambling. Don’t ignore body language. Your non-verbal cues can undermine your spoken words. Maintaining eye contact and a confident posture is crucial. Also, avoid asking about salary or benefits too early. Focus on demonstrating your value first before discussing compensation. Lastly, underestimating the power of follow-up is a frequent misstep. Sending a thank-you note can keep you top of mind and show appreciation for the opportunity. Avoid these pitfalls to enhance your interview performance.

Technical skills are essential, but soft skills can set you apart. In the high-stakes world of quantitative finance, I believe demonstrating effective communication and teamwork is vital. Mastering algorithms and models is crucial, yet the ability to articulate your ideas and collaborate seamlessly with others is equally important. Both skill sets are necessary for true success.

Practicing programming and mathematics is essential for anyone looking to enhance their financial skills. I believe that these disciplines empower us to analyze data, create budgets, and make strategic investment choices. Regular practice sharpens our ability to assess opportunities and risks, ultimately helping us achieve financial freedom. Don’t underestimate the impact of these skills on your financial journey!

Behavioral questions reveal how individuals approach challenges and work with others. In the financial world, understanding a person’s mindset is crucial for success. Technical skills matter, but without the right attitude, those skills fall flat. Prioritizing behavioral insights allows for better collaboration and decision-making.

Mock interviews drastically enhance your performance. By simulating real interview scenarios, I’ve sharpened my skills, built confidence, and gained invaluable feedback. These practice sessions reveal areas for improvement that I hadn’t noticed before. Whether you’re preparing for a financial position or any role, investing time in mock interviews is essential for success.

Networking is crucial for unlocking financial potential. I’ve seen firsthand how building relationships leads to opportunities that can significantly boost your finances. Connecting with industry experts and like-minded individuals brings insights that purely academic knowledge can’t provide. Don’t underestimate the power of a strong network!

Continual learning is critical in the rapidly evolving finance sector. I’ve seen firsthand how quickly markets change and how new regulations emerge. Staying updated with the latest trends and knowledge not only enhances my financial decisions but also empowers me to seize opportunities. If you want to unlock your financial potential, embrace a mindset of lifelong learning.

I’ve seen firsthand how real-world case studies can profoundly impact financial understanding. **They illustrate complex ideas in relatable terms, making it easier to see how strategies work in practice.** These examples not only enlighten but also empower us to make smarter financial choices. **They bridge the gap between theory and reality, giving us a clearer path to financial freedom.**