The Future of Finance with Blockchain Technology

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.

The Significance of Smart Contracts in Financial Transactions

Smart contracts are changing the game in finance. They’re like automated agreements that execute when conditions are met. No middlemen, no delays—just pure efficiency.

Most people think smart contracts are just a cool tech gimmick. But I believe they represent a fundamental shift in how we handle transactions. Imagine insurance claims processed instantly when conditions are met. It’s that simple!

According to the University of Tulsa, “Smart contracts are facilitating innovative financial products that were previously unimaginable.” This isn’t just hype; it’s a reality that’s already unfolding.

But let’s talk about alternatives. Many experts advocate for the broad use of smart contracts. I think we should consider hybrid agreements that blend smart contracts with traditional legal frameworks. This mix could provide the best of both worlds, ensuring that complex legalities are still respected.

And what about the legal implications of these contracts? They raise questions about enforceability and jurisdiction. As we adopt smart contracts more widely, we need clarity in legal frameworks governing their use.

In the end, smart contracts aren’t just tech innovations. They are paving the way for a future where transactions are faster, cheaper, and more transparent. Let’s embrace this change!

Blockchain/DLT drives simplicity and efficiency by providing a new, foundational technology for next-generation financial services infrastructure with a range …

Blockchain Technology, Digital Assets, and the Future of Finance

… financial technologies such as blockchain and AI become more prevalent. By demystifying the forces shaping the financial services industry, executives will …

Future of Finance: Leveraging Fintech Innovation | Columbia …

May 12, 2023 … How will finance change in the future? Get a closer look at the future of finance with fintech such as blockchain, crypto, and more.

Security and efficiency improvements in payment systems

Exploring how blockchain technology enhances security and efficiency in payment systems reveals its transformative potential in finance.

- Blockchain enhances transaction security. It makes fraud nearly impossible by providing a transparent ledger.

- Transactions are faster. No intermediaries mean instant processing and reduced wait times.

- Cost savings are significant. Lower transaction fees make financial services accessible to more people.

- Decentralization fosters trust. Everyone can see the same information, ensuring no one can manipulate it.

- Smart contracts automate processes. They execute transactions automatically when conditions are met, reducing manual errors.

- AI integration can enhance efficiency. According to Forbes, AI can analyze blockchain data to streamline operations.

- CBDCs are on the rise. Central Bank Digital Currencies promise to redefine payment systems and improve security.

Understanding Blockchain Technology and its Role in Finance

Blockchain technology is reshaping finance. It’s not just about cryptocurrencies anymore. This tech provides a decentralized way to confirm transactions, boosting trust and transparency.

Many believe that blockchain is mainly for trading digital currencies. I think it’s a lot more. Its distributed ledger reduces fraud risks and enhances system integrity.

While traditional systems rely on central authorities, blockchain allows multiple parties to validate transactions. This shift is monumental for financial operations. It streamlines processes and cuts transaction costs.

Some argue for centralized databases with encryption as a safer option. I disagree because those solutions can’t match blockchain’s transparency. Blockchain’s decentralized nature fosters greater financial inclusion.

Consider how blockchain can empower the underbanked. With mobile wallets, they can access financial services without traditional banks. This democratization of finance is revolutionary.

As regulations evolve, the landscape will change. Understanding these shifts is crucial for finance professionals. They must adapt to new compliance requirements and leverage blockchain’s potential.

Moreover, the rise of Central Bank Digital Currencies (CBDCs) hints at a future where governments embrace blockchain. This could redefine monetary policy and consumer privacy.

In conclusion, blockchain is not just a trend; it’s a transformative force in finance. We are witnessing the dawn of a new financial era.

AI and Blockchain: A Transformative Partnership

Most people think that AI and blockchain work together seamlessly. I believe there’s a need for caution because over-reliance on automation can lead to ethical dilemmas. Balancing human intuition with AI’s capabilities is key.

AI can analyze vast amounts of blockchain data to spot fraud. But without human oversight, we risk missing context and nuance. According to Forbes, “AI and ML’s ability to analyze vast amounts of data and automate complex tasks is a game-changer in a data-rich and time-sensitive industry.”

Imagine using AI to enhance customer interactions while still keeping a human touch. This hybrid approach can build trust and ensure ethical standards in finance.

Let’s talk about the challenges of this partnership. Data privacy is a big concern. If AI mishandles sensitive information on a blockchain, the consequences could be severe.

Another critical issue is algorithmic bias. If AI systems are biased, they can lead to unfair financial decisions. We must prioritize ethical guidelines in AI utilization.

There’s a fascinating topic emerging: the challenges of implementing AI in blockchain. Addressing data privacy, bias, and ethical standards is crucial for creating a secure financial future.

So, while AI and blockchain can be transformative, we need to tread carefully. Combining these technologies should enhance human decision-making, not replace it.

For more insights, check out the Forbes article on emerging fintech trends.

Blockchain/DLT drives simplicity and efficiency by providing a new, foundational technology for next-generation financial services infrastructure.

Blockchain Technology, Digital Assets, and the Future of Finance

Whether you understand digital currency or not, executives need to understand Fintech, blockchain technology, and the strategic ramifications these disruptive …

Leveraging Fintech Innovation for the Future of Financial Services

Buy Bitcoin, Ethereum, and other cryptocurrencies on a platform trusted by millions.

Sep 18, 2023 … The second is the exploding popularity of financial technology, or … blockchain technology (Figure 1). The fintech industry has grown …

Latinos and the future of finance: Why we need to examine the …

Enhancing Financial Inclusion with Blockchain Solutions

Many believe blockchain is the ultimate solution for financial inclusion. I see it differently. While blockchain offers access, it’s not the only answer. A hybrid model that merges blockchain with traditional banking can be more effective. This approach combines the best of both worlds, easing the transition for underserved populations.

Consider this: blockchain can empower unbanked individuals, but it often requires tech-savvy users. A blend of blockchain and existing banking systems can provide a familiar path. This way, people can gradually embrace new technologies.

Organizations are making strides in microfinance using blockchain. Yet, challenges remain, such as regulatory hurdles and the need for robust infrastructure. A collaborative effort is essential for success.

According to IBM, “CBDC has the potential to transform the future of payments.” This highlights the importance of central bank digital currencies in enhancing financial inclusion. They can reach those who traditional banks overlook, offering a lifeline to many.

Most experts advocate for blockchain’s role in financial inclusion. But I argue for a more nuanced approach, integrating APIs and legacy systems. This can streamline access and reduce risks associated with purely decentralized models.

Another exciting area is blockchain-based microlending platforms. They can provide small loans to those in need, bypassing traditional barriers. This could be a game changer for many aspiring entrepreneurs.

In conclusion, while blockchain is a valuable tool, it’s not a silver bullet. A multifaceted strategy will yield the best outcomes for enhancing financial inclusion.

Emerging Trends in Digital Payments and Central Bank Digital Currencies

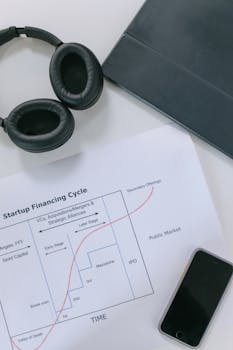

Many believe digital payments will remain tied to traditional banking. I think that’s a narrow view because the rise of Central Bank Digital Currencies (CBDCs) is changing the game. Countries are exploring CBDCs to enhance transaction efficiency and security.

Imagine a world where payments are instant, secure, and accessible to everyone. CBDCs can democratize finance, especially for those lacking access to traditional banking. According to the IBM Blog, “CBDC has the potential to transform the future of payments.”

While many see CBDCs as a logical evolution, I believe we should consider decentralized finance (DeFi) as a serious alternative. Most experts think CBDCs will dominate, but I argue that DeFi can empower users by eliminating intermediaries. This shift could redefine how we view financial autonomy.

There’s a buzz around digital wallets too. They’re not just convenient; they represent a shift in consumer behavior. People want fast and secure transactions, and blockchain can deliver that.

We should also address the challenges of implementing CBDCs. Privacy concerns, regulatory frameworks, and technological infrastructure need careful consideration. Only then can we unlock the full potential of digital currencies.

As we navigate this exciting landscape, let’s keep an eye on how these trends unfold. The convergence of CBDCs and blockchain could redefine our financial systems.

Automating financial agreements and reducing fraud

Blockchain technology is transforming how we handle financial agreements. Here’s how it’s making waves:

- Smart contracts execute automatically. They cut out the middleman, saving time and reducing costs.

- Fraud becomes harder. Transactions are recorded on a secure, immutable ledger.

- Transparency is key. All parties can see the same information, promoting trust and accountability.

- Dispute resolution is streamlined. Smart contracts can include predefined conditions for resolving issues.

- Regulatory compliance improves. Automated processes can adapt to legal changes quickly.

- Risk management is enhanced. Real-time data analysis helps identify and mitigate risks before they escalate.

- Cost efficiency skyrockets. Lower operational costs mean better margins for businesses.

- No way! The potential for reduced fraud is a game-changer for financial institutions.

- Decentralized finance (DeFi) is on the rise. It’s creating new opportunities for peer-to-peer transactions.

Potential benefits for underbanked populations

Exploring how blockchain technology can empower underbanked communities.

- Blockchain opens doors for unbanked individuals. They can access financial services without traditional banks.

- Lower transaction fees are a game changer. This makes it easier for people in remote areas to save and invest.

- Mobile wallets powered by blockchain are the future. They enable seamless transactions and economic participation.

How can blockchain improve financial inclusion?

Many believe blockchain is the key to financial inclusion. I think it’s more than that. It’s a lifeline for the unbanked.

Imagine accessing financial services without a bank. Blockchain enables this by providing decentralized platforms that anyone can use. No middlemen, no barriers.

Lower transaction fees are a game changer. This means affordable access to services like savings and loans. It’s that simple!

While some argue for sticking with traditional banking, I see a hybrid model as the future. Integrating blockchain with existing systems can ease transitions for many.

According to IBM, “CBDC has the potential to transform the future of payments.” That’s a big deal for underbanked populations!

Let’s not forget blockchain-based microlending. It empowers small borrowers in developing markets, breaking down financial barriers.

In conclusion, the potential is enormous. Blockchain isn’t just tech; it’s a movement towards a more inclusive financial world.

What is blockchain technology and how does it work?

Blockchain technology is a game-changer in finance. It’s a decentralized ledger that records transactions across multiple computers. This means no single entity controls it, which enhances security and trust.

In simple terms, when you make a transaction, it gets bundled with others into a block. Once that block is filled, it’s added to the chain of previous blocks. This process is transparent and tamper-proof.

Many believe blockchain is just for cryptocurrencies, but its applications go beyond that. It can streamline processes in various sectors, including supply chains and healthcare. It’s that simple!

Some experts argue that a hybrid model, combining blockchain with existing systems, could be more effective. This approach might simplify regulatory compliance while maintaining security. I think this could be a smart way to ease into blockchain technology.

As we explore the future of finance, understanding blockchain’s potential is key. From enhancing security to reducing transaction costs, its impact is profound. Let’s keep an eye on how this technology evolves!

What are smart contracts and why are they important?

Smart contracts are like digital agreements that automatically execute when conditions are met. Most people think they’re just fancy code, but I see them as a way to cut out the middleman in financial transactions. They save time and reduce costs, making everything smoother.

For example, in insurance, a smart contract can trigger payouts instantly when a claim meets predefined criteria. No more waiting around! According to the University of Tulsa, “smart contracts are facilitating innovative financial products that were previously unimaginable.”

Some argue that smart contracts are the future of finance. But I believe a hybrid approach is better. Combining smart contracts with traditional legal frameworks can provide a safety net for complex agreements.

This way, we keep the benefits of automation while ensuring legal integrity. As we move forward, understanding the legal implications of smart contracts becomes critical.

Exploring these aspects will help us navigate the future of finance more effectively.

How does AI interact with blockchain technology?

Many believe AI and blockchain are a perfect match. But I think it’s not just about automation; it’s about synergy. AI can analyze blockchain data, spotting patterns and preventing fraud.

Most discussions focus on AI enhancing blockchain’s security. I argue that it’s equally about improving user experience. By tailoring financial services to individual needs, AI can make blockchain more accessible.

Some experts emphasize fully automated systems. However, I believe a balance is key. Human oversight in decision-making can maintain ethical standards and trust.

As AI evolves, so should our approach to integrating it with blockchain. Understanding the legal implications of this partnership is crucial. This includes enforceability and jurisdiction of automated contracts.

Incorporating AI into blockchain isn’t just about efficiency; it’s about redefining finance for everyone. The collaboration can lead to innovative solutions that traditional systems can’t offer.

According to Forbes, “AI and ML’s ability to analyze vast amounts of data and automate complex tasks is a game-changer in a data-rich and time-sensitive industry.” This highlights the importance of this intersection in shaping the future of finance.

What are Central Bank Digital Currencies (CBDCs) and their benefits?

Central Bank Digital Currencies (CBDCs) are digital forms of a country’s fiat currency issued by the central bank. Unlike cryptocurrencies, CBDCs are regulated and backed by the government. They aim to enhance payment efficiency and security.

Many believe CBDCs will transform how we conduct transactions. I think they offer a unique opportunity to streamline monetary policy. With instant transactions, it could reduce the reliance on cash and traditional banking methods.

CBDCs can improve financial inclusion, especially for those without access to banking services. By providing a secure digital wallet, they can empower underbanked populations. This could lead to a more equitable financial system.

Critics argue that CBDCs might infringe on privacy. I believe the benefits outweigh the risks, especially with proper regulations in place. According to the IBM Blog, ‘CBDC has the potential to transform the future of payments.’

As we move forward, understanding CBDCs will be crucial. They are more than just a trend; they represent the future of finance. It’s exciting to think about how they might reshape our economy!

What regulations are emerging for blockchain and cryptocurrency?

Most people think regulations are just about compliance and control. But I see it differently. Emerging regulations can actually drive innovation in the blockchain space.

For instance, many countries are developing frameworks that promote transparency while still fostering growth. According to the IBM Blog, CBDCs are reshaping how we think about digital currencies.

Some experts believe that stricter regulations could stifle creativity. I argue that they can actually create a safer environment, encouraging more players to enter the market.

While many see regulations as a barrier, I think they can be a catalyst for change. They can help standardize practices and build trust among users.

Let’s not forget about the importance of consumer protection. Regulations can help safeguard users from fraud and scams, ensuring a more stable financial ecosystem. As the University of Tulsa mentions, the future of fintech relies heavily on trust and security.

As we navigate this evolving landscape, it’s crucial to keep an eye on how regulations will shape the future of blockchain and cryptocurrency.

Most people think AI and blockchain should work together seamlessly. But I believe we need to tread carefully. Relying too much on automation can overlook human intuition.

Imagine AI analyzing blockchain data for fraud detection. It’s powerful, but without human oversight, we risk missing nuances that algorithms can’t grasp. The blend of technology and human insight can create a more balanced approach.

As Forbes puts it, “AI and ML’s ability to analyze vast amounts of data and automate complex tasks is a game-changer.” But we must ask—are we losing the personal touch?

New conversations around the ethical implications of AI in finance are emerging. We should explore how to implement AI responsibly, ensuring it complements human judgment rather than replacing it.

Most folks think smart contracts are just a tech fad. I believe they’re the future because they cut out middlemen and speed up transactions. Imagine getting your insurance payout automatically when conditions are met—no waiting!

Many argue that these contracts are risky due to their rigidity. However, I think hybrid agreements combining smart contracts with traditional methods offer the best of both worlds. They maintain legal integrity while enjoying the speed of automation.

According to The University of Tulsa, “Smart contracts are facilitating innovative financial products that were previously unimaginable.” This shows how they’re reshaping the finance landscape.

Let’s not forget the legal implications of smart contracts. As they gain traction, understanding their enforceability and jurisdiction becomes crucial. It’s a fascinating area that deserves more attention!

Most people believe blockchain is just about cryptocurrencies. But I think it’s way more than that. The transparency it offers is a game-changer for finance.

Every transaction is recorded and visible, which builds trust among parties. No way can you cheat the system! As Park University states, “Blockchain technology is sometimes called distributed ledger technology or DLT.”

People often think traditional banking is secure. But with blockchain, security is amplified. It’s decentralized, meaning no single point of failure. This could reshape how we view trust in finance.

While many advocate for public blockchains, I believe in exploring hybrid models. Combining blockchain with existing systems might offer the best of both worlds. It could simplify compliance while maintaining security.

Let’s not forget the emerging regulations around this tech. They’ll play a big role in how we use blockchain in the future. Understanding these changes is crucial for anyone in finance.

For more insights, check out Park University and The University of Tulsa.

Digital wallets are transforming payment methods. They offer speed and convenience. No way! Central Bank Digital Currencies (CBDCs) are leading this change.

Many believe CBDCs will replace traditional banking. I think they will coexist, enhancing existing systems. This hybrid approach could provide flexibility and security.

According to the IBM Blog, “CBDC has the potential to transform the future of payments.” This is just the beginning.

Imagine seamless transactions across borders. The future is bright with blockchain and digital currencies. Let’s embrace these changes!

Many believe that the future of blockchain is solely driven by innovation. I think regulations will play a pivotal role because they can either encourage or stifle growth.

Most experts suggest that tighter regulations will enhance security and trust. But I argue that excessive regulation might hinder the agility needed for blockchain to thrive.

As governments explore frameworks for cryptocurrencies, we might see a more structured environment. This could lead to a balance between innovation and compliance, allowing blockchain to flourish while addressing risks.

According to the Park University Blog, ‘Blockchain technology is sometimes called distributed ledger technology or DLT.’ This highlights its evolving nature.

Understanding these regulations is crucial for anyone looking to invest in or utilize blockchain technology. It’s that simple!

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.