Finance Cheat Sheet

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.

The Importance of Emergency Funds

Having an emergency fund is one of the smartest financial strategies you can implement. The unpredictability of life can throw unexpected expenses our way, such as medical bills, car repairs, or sudden job loss. Without an emergency fund, these financial surprises can lead to stress and even debt. I cannot stress enough how vital an emergency fund is for financial security. It acts as a safety net that empowers you to tackle unforeseen costs without jeopardizing your investing goals or derailing your progress in other financial areas.

Another critical aspect is peace of mind. Knowing you have money set aside for emergencies can alleviate financial anxiety. This allows you to focus on more important financial decisions, such as investing or saving for retirement, without the constant worry of whether you can manage an unexpected bill. Moreover, an emergency fund contributes to your overall financial resilience.

The common guideline is to save three to six months’ worth of living expenses. This guideline serves as a solid foundation for an effective emergency fund. However, every situation is different. Depending on your job stability, family situation, and financial obligations, you might need to tailor this amount to suit your needs.

Ultimately, building an emergency fund is a stepping stone toward achieving financial freedom. It allows you to take calculated risks in investments without fear of immediate financial insolvency. By prioritizing an emergency fund, you are setting yourself up for long-term financial success while creating a buffer that allows you to navigate through life’s unpredictable challenges.

Smart Saving Strategies

Smart saving is an essential cornerstone of financial success. I’ve learned that a well-structured approach to savings can drastically improve your financial situation. Start by establishing a clear savings goal. Whether it’s for a vacation, an emergency fund, or a major purchase, knowing what you’re saving for gives your efforts purpose. Without a target, it’s easy to lose focus and motivation.

Next, automate your savings. Set up a direct deposit that funnels a portion of your paycheck straight into a savings account. This method ensures that you don’t miss the money, which can significantly boost your savings over time. Automation eliminates the temptation to spend what you should be saving.

Also, consider using high-yield savings accounts or money market accounts. They typically offer better interest rates than traditional savings accounts, allowing your money to grow faster with less risk. Every little bit of interest makes a difference in the long run.

Another effective strategy involves embracing the 50/30/20 budgeting rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings. This straightforward breakdown helps in clearly visualizing where your money goes.

Lastly, stay aware of market trends and adapt your strategies accordingly. The financial environment is ever-changing, and what worked last year might not be as effective now. Being proactive can make a significant difference in your financial health. Remember, smart saving isn’t just about cutting back; it’s about making your money work for you.

Creating a Budget That Works for You

Creating a budget that truly works for you requires a clear understanding of your financial habits and goals. **It’s essential to start with a thorough review of your income and expenses.** List all sources of income, including your salary, side hustles, and any passive income streams. Then, track your expenses meticulously for at least a month to see where your money is going. You might be surprised at how quickly small purchases add up!

Next, categorize your expenses into fixed (rent, utilities) and variable (groceries, entertainment) costs. **By identifying which expenses are necessary and which could be reduced, you position yourself for better management of your finances.** If you’re finding it challenging to cut down on variable costs, consider setting spending limits for categories like dining out or hobbies. Treat this as a fun challenge rather than a punishment.

Once you have a clear picture of your financial situation, establish your priorities. What are your immediate financial goals? Do you want to save for a vacation, pay off debt, or build an emergency fund? **Setting clear, achievable goals can motivate you to stick to your budget.** Break these goals into smaller, actionable steps to make them less daunting.

Lastly, don’t forget to regularly review and adjust your budget. Life is unpredictable—bills appear, and incomes fluctuate. **An effective budget must be a living document, flexible enough to accommodate changes while keeping your objectives front and center.** Keep it utilitarian but also rewarding; allow yourself a small indulgence when you hit a milestone.

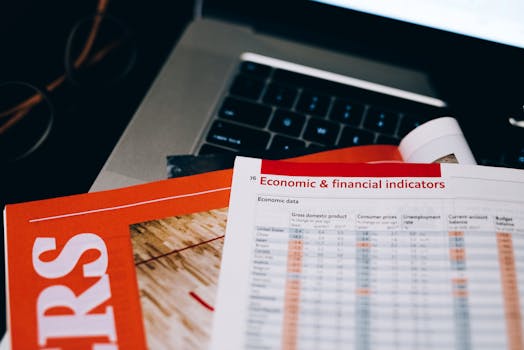

Comparison of Different Investment Options

This table compares various investment options, highlighting their features, risks, and advantages to help you make informed financial decisions:

| Investment Option | Risk Level | Liquidity | Potential Returns | Time Horizon |

|---|---|---|---|---|

| Stocks | High | High | 10-15% | Long-term |

| Bonds | Medium | Medium | 4-6% | Medium to Long-term |

| Real Estate | Medium | Low | 8-12% | Long-term |

| Mutual Funds | Medium | Medium | 5-10% | Medium to Long-term |

| Savings Accounts | Low | High | 1-2% | Short-term |

Benefits of Diversifying Your Portfolio

Exploring the advantages of spreading your investments across various assets.

- Reduces risk: By diversifying, I lessen the chances of significant losses. If one asset underperforms, others often catch up.

- Enhanced potential returns: Different investments behave uniquely in various market conditions. This strategy allows me to tap into multiple opportunities for growth.

- Smoothes volatility: A well-diversified portfolio tends to experience less fluctuation. That means I enjoy a more stable investment journey.

- Access to new markets: Diversification opens doors to different sectors and geographies, offering fresh avenues to explore.

- Eases emotional decision-making: With varied assets, I can withstand market ups and downs better, reducing the impulse to react hastily.

Key Factors in Successful Budgeting

Effective budgeting can significantly improve your financial situation. Here’s what I’ve learned along the way.

- Set clear financial goals. Having specific targets allows for focused budgeting and spending.

- Track your expenses accurately. This habit unveils spending patterns and helps identify areas for potential savings.

- Create a realistic budget. Ensure your budget reflects your actual income and necessary expenditures while allowing some flexibility for the unexpected.

- Review and adjust regularly. Life changes, so should your budget. Regular reviews keep it relevant and effective.

- Prioritize savings with ‘pay yourself first’. Allocate a portion of your income to savings before tackling other expenses. This will grow your financial security over time.

- Stay disciplined. Sticking to your budget consistently is crucial for long-term success. It’s easier said than done, but discipline pays off significantly.

Finance & Administration. Budget & Ledger Queries. Form. Purpose. FGITBAL. FGITBSR. Current Claim on Cash & other Balance Sheet accounts. FGIBSUM. Organization …

Understanding your decisions' financial implications and communicating them to stakeholders can help you drive results and advance your career.

Nov 13, 2014 … Last Updated: September 25, 2023 Purpose: A cheat sheet containing Banner Finance 9 references. Contact Email: finsystems@charlotte.edu

Understanding Financial Terms

Mastering financial terminology is essential for anyone looking to unlock their financial potential. Familiarizing yourself with these terms allows for a clearer understanding of your options and helps you take control of your finances. Let’s dive into a few key financial terms that can make a huge difference in how you approach investing, saving, and budgeting.

First up is the concept of asset allocation. This refers to distributing your investments among various asset categories, such as stocks, bonds, and real estate. Proper asset allocation can help mitigate risks and enhance returns, making it a vital strategy for individual investors.

Next, consider liquidity. This term describes how quickly an asset can be converted into cash without affecting its market price. Cash is the most liquid asset, while real estate is among the least. Knowing the liquidity of your assets can inform your financial strategy significantly.

Another crucial term is diversification. This involves spreading your investments across various financial instruments to reduce exposure to any single asset or risk. A diversified portfolio can help stabilize your returns and reduce volatility.

Risk tolerance is another important term. This relates to your ability to endure fluctuations in your investment’s value. Understanding your risk tolerance assists in shaping your investment choices and helps you find a balance that feels comfortable.

Compound interest is a game-changer for anyone serious about savings. Unlike simple interest, which is calculated only on the principal amount, compound interest is calculated on the principal plus any accumulated interest. This means your money can grow exponentially over time, making early investments incredibly beneficial.

Finally, never underestimate the significance of budgeting. It’s the foundation of any financial plan. Creating and sticking to a budget helps you understand where your money goes and plan effectively for your financial goals.

By grasping these terms, you position yourself for clearer, smarter financial actions. Whether you’re investing, saving, or budgeting, understanding financial terms creates a solid groundwork for achieving your financial aspirations.

Codes. Action. Banner 9. Keystroke. Cancel Page, Close Current. Page, or Cancel Search/Query. Ctrl + Q. Choose/Submit. Enter. Clear All in Section. Shift + F5.

Financial Terms Cheat Sheet. Whether you're a recent graduate, aspiring investor, new leader, or seasoned mid-career professional, financial fluency is …

Nov 23, 2023 … This essential list of top finance Cheat Sheets brings together decades of experience from those working in finance and sharing one page guide …

Jul 17, 2022 … 1.6K votes, 53 comments. 1.2M subscribers in the FinancialCareers community. Plan your career in the wide world of finance.

Finance “cheat sheet” I stole from LinkedIn : r/FinancialCareers

Investment Basics for Beginners

Understanding the core principles of investing is crucial for anyone looking to build wealth. It’s not about throwing your money into the stock market and hoping for the best; it’s about making strategic choices that align with your financial goals. Let’s break down some essential concepts.

First, it’s vital to comprehend the power of compound interest. The earlier you start investing, the more your money can work for you over time. Waiting to invest can mean missing out on substantial growth.

Next, get familiar with different types of investment vehicles. Stocks, bonds, mutual funds, and real estate each have their own risk and return profiles. Diversity is key; spreading your investments can minimize risk. Placing all your resources in one sector is a gamble that could cost you dearly.

Another critical element is risk tolerance. Everyone has a different comfort level when it comes to risk, influenced by factors such as age, financial situation, and investment goals. Knowing your risk tolerance helps you select investments that suit your personality.

Also, consider setting up an emergency fund before diving into investments. This ensures you have a financial cushion in case unexpected expenses arise, reducing the likelihood that you’ll need to liquidate investments prematurely. Having this safety net allows you to invest with more confidence.

Lastly, always research before committing your hard-earned money. Market trends and economic conditions can greatly influence investment performance. Utilize resources like financial news, analysis from experts, and historical data to guide your choices. Investing is not a gamble; it’s a calculated effort that rewards those who are diligent.

Tax Planning Tips for Individuals

Tax planning is essential for maximizing your financial potential. As someone who’s navigated the complexities of personal finance, I can assure you that effective tax strategies can elevate your financial standing significantly.

First and foremost, take advantage of tax-advantaged accounts like IRAs and 401(k)s. Contributing to these accounts reduces your taxable income now, allowing your investments to grow tax-free until withdrawal. If your employer offers a matching contribution, ensure you’re contributing enough to receive that full match; it’s literally free money.

Next, diversify your investments. Holding a mix of assets can lower your overall tax burden. Familiarize yourself with the long-term and short-term capital gains tax rates; claiming long-term investments helps you keep more of your returns.

Also, don’t overlook potential tax deductions. Whether it’s for mortgage interest, student loans, or medical expenses, being diligent about tracking these expenses can lead to significant tax savings. Utilize apps or spreadsheets to keep your records organized throughout the year.

Consider your filing status carefully—something as simple as being married or single can affect your tax rate. Choosing the right filing status can optimize your tax outcomes. Examine all available options to ensure you’re benefiting from the most favorable status.

Finally, consult a tax professional, especially if your financial situation is complicated. Their expertise can uncover tax-saving opportunities you might overlook.

Implementing these tips can significantly enhance your financial position each year. Each dollar saved on taxes is a dollar that can be invested or used for your personal goals.

Retirement Planning: Steps to Start Early

Starting your retirement planning early can make all the difference in your financial future. The earlier you begin, the more time your money has to grow through compound interest. I can’t stress enough how vital it is to establish a savings habit while you’re still young. This step lays the foundation for a secure future.

The first step I recommend is determining your retirement goals. Ask yourself how you envision your retirement. Want to travel, pursue hobbies, or simply relax? Knowing your goals helps shape your savings and investment strategy.

Next, assess your current financial situation. Understand your income, expenses, debts, and savings. This assessment gives you clarity on how much you can set aside each month. Even small contributions add up over time. I believe every little bit counts, and it’s about consistency rather than large sums.

Another crucial step is to take advantage of employer-sponsored retirement plans. If your employer offers a 401(k) or similar plan, enroll as soon as possible. Often, they provide matching contributions, which is essentially free money. If you don’t contribute, you’re leaving money on the table.

Educate yourself on different retirement accounts. Options like IRAs can help diversify your savings. I think understanding the tax implications and benefits of each account type is essential for maximizing your investment potential.

Establishing an emergency fund is also vital. Life can be unpredictable, and having a safety net ensures you won’t dip into your retirement savings for unexpected expenses. Aim for three to six months’ worth of living expenses set aside before aggressively saving for retirement.

Finally, review and adjust your plans regularly. Financial situations change, and your retirement strategy should evolve accordingly. I always recommend revisiting your goals and savings at least once a year. This ensures you’re on track and making any necessary adjustments along the way.

Managing Debt Effectively

Debt is not inherently bad; it’s how we manage it that matters. I firmly believe that effective debt management can enhance financial freedom, allowing us to leverage borrowed money wisely. First, I always advocate for a clear understanding of your total debt. Listing all debts with interest rates and due dates can seem tedious, but it’s essential for setting priorities. Focus on high-interest debts first. Paying those off can free up cash flow more quickly than chipping away at lower interest ones.

Next, creating a budget plays a critical role. I recommend allocating a specific portion of your monthly income to debt repayment. This doesn’t mean sacrificing all your enjoyment; rather, it involves recalibrating priorities. Cutting unnecessary expenses can create room for that debt payment, making the path to financial liberation clearer.

Consider consolidating debts if you’re juggling multiple payments. A personal loan or balance transfer credit card can streamline payments and possibly lower your interest rate, but be cautious. Avoid the trap of accumulating more debt on a credit card after transferring balances. Instead, actively work to pay off the consolidated amount.

Another strategy I can’t stress enough is communication with creditors. If you’re struggling, don’t hesitate to reach out—they often have programs to help manage your payments. Being proactive can prevent escalating issues later. Remember, every little bit counts, and staying on top of payments, even if they’re smaller than planned, is better than falling behind.

Lastly, keep an eye on your credit score. High debt might impact it negatively, but timely payments can enhance it over time. A good credit score opens doors for better loan terms and even lower insurance premiums. Managing debt effectively is not just about paying it off; it’s about positioning yourself for financial growth.

Utilizing Financial Tools and Apps

In today’s fast-paced world, financial tools and apps are essential for anyone serious about managing their money effectively. I’ve personally experienced how these resources can transform my financial health. With a few taps on my smartphone, I can keep track of my spending, build a budget, and analyze my investment performance.

Budgeting apps have been game-changers for me. They allow me to categorize my expenses and set specific goals, which ensures I stay within my limits. The visual representation of my spending habits keeps me accountable and motivated to save more. Whether it’s setting aside money for a vacation or tackling debt, these tools make the process straightforward.

When it comes to investments, I swear by my investment tracking app. Having real-time access to my portfolio performance makes me a more confident investor. I can evaluate my stocks at a glance and make snap decisions based on the latest market trends. The ability to track different assets and receive alerts on significant changes is invaluable.

And let’s not forget the savings apps! I use an app that rounds up my purchases and saves the change. This has allowed me to save without even thinking about it, turning spare change into a reliable financial cushion. It’s astonishing how small, consistent contributions can accumulate over time.

Security is an absolute necessity when using these tools. Make sure to choose apps that prioritize encryption and user privacy. I always read reviews and do my research to ensure my financial data is safe. Your financial health deserves the utmost protection.

There’s no denying that financial tools and apps can significantly impact your financial journey. They provide clarity, efficiency, and control over your money. It’s imperative to explore and find the ones that align with your financial goals and habits. With technology on our side, achieving financial freedom is more attainable than ever.

Top Financial Books to Read

Exploring the best financial books can unlock an understanding that transforms your financial situation. These picks have truly shaped my own approach to wealth management and have the potential to do the same for you.

- 1. ‘The Intelligent Investor’ by Benjamin Graham: This classic teaches timeless principles of value investing that I believe every serious investor should grasp.

- 2. ‘Rich Dad Poor Dad’ by Robert Kiyosaki: Kiyosaki’s personal narrative challenges conventional wisdom around money and investing, reminding us that financial education is crucial.

- 3. ‘Your Money or Your Life’ by Vicki Robin and Joe Dominguez: This book transforms one’s relationship with money. It helped me realize how to achieve financial independence through conscious spending.

- 4. ‘The Total Money Makeover’ by Dave Ramsey: Ramsey’s straightforward steps to getting out of debt and budgeting are practical and efficient, making it a must-read for anyone needing financial discipline.

- 5. ‘The Millionaire Next Door’ by Thomas J. Stanley and William D. Danko: This eye-opening research reveals surprising facts about the habits and traits of America’s millionaires, which has influenced my own wealth-building strategies.

- 6. ‘Thinking, Fast and Slow’ by Daniel Kahneman: While not strictly about finance, this book offers valuable insights into human judgment and decision-making that directly affect our financial choices.

- 7. ‘The Simple Path to Wealth’ by JL Collins: Collins provides a pathway to financial freedom that’s easy to understand and execute. I found it refreshing and immensely helpful for anyone starting their investment journey.

The Psychology of Money: Changing Your Mindset

Understanding the psychology of money is crucial for anyone looking to improve their financial situation. It’s not merely about the numbers; it’s how we perceive and interact with money that defines our financial success. Our beliefs, experiences, and emotions surrounding money can shape our approach to saving, spending, and investing. I’ve seen countless individuals struggle not because they lack the necessary income or resources, but because of their limiting beliefs about money.

Changing your mindset can be the catalyst for unlocking your financial potential. The first step is recognizing that money is a tool—not a measure of self-worth. By shifting the focus from accumulation to strategic growth, we can change how we approach financial decisions. Whether you’re looking to cut expenses or explore new investment opportunities, a positive mindset lays the foundation for action.

Additionally, embracing a mindset of abundance instead of scarcity can radically transform your relationship with money. This involves focusing on opportunities rather than limitations. Seeing money as a resource that can grow and multiply allows you to invest in yourself, whether through education or smart financial ventures.

Remember, it’s essential to cultivate resilience when setbacks occur. Every financial misstep holds valuable lessons that can be turned into stepping stones toward success. Reflect on what went wrong, learn from it, and adjust your strategies accordingly.

Ultimately, changing your mindset about money opens doors to financial freedom. By understanding your psychological barriers and working actively to dismantle them, you can create a more prosperous and fulfilling financial life. Take the time to alter your perceptions, and you’ll pave the way for informed financial choices that align with your true goals.

Common Mistakes to Avoid When Investing

Avoiding these common pitfalls can significantly enhance your investment experience and financial outcomes.

- Ignoring research is a fatal flaw. I can’t stress enough how essential it is to understand what you’re investing in before you commit your hard-earned money.

- Chasing past performance is misguided. Just because a stock has soared in the past doesn’t mean it will continue to do so. Always consider other factors.

- Emotional decisions lead to losses. Staying disciplined and sticking to your strategy can prevent hasty moves that could cost a fortune.

- Underestimating risk is naive. Every investment carries risk. Assess it realistically to protect your assets.

- Neglecting to diversify is dangerous. Putting all your eggs in one basket exposes you to unnecessary risk that could jeopardize your financial future.

- Overtrading is detrimental. Frequent buying and selling can incur hefty fees and taxes, eating into your returns.

- Ignoring fees adds up. Be mindful of transaction costs, management fees, and other expenses that can significantly impact your bottom line.

Tips for Navigating Market Trends

Understanding market trends is essential if you want to maximize your financial potential. Keep your ear to the ground; awareness is your greatest ally. Regularly follow economic news, stock reports, and expert analyses to grasp what influences market fluctuations.

It’s also crucial to avoid emotional trading. Letting fear or greed dictate your actions can lead to disastrous outcomes. Stick to your strategy and make decisions based on data, not impulses.

Consider diversifying your portfolio. Don’t put all your eggs in one basket. By spreading investments across various sectors, you buffer against volatility.

Engage with online communities and forums. Collaboration often unveils fresh perspectives that can enhance your understanding of market trends. Surrounding yourself with knowledgeable individuals can stimulate your insights.

Utilize technology to your advantage. Tools for tracking market trends and analyzing data are plentiful. Platform analytics can help you identify patterns that may influence your trading decisions.

Set realistic goals and benchmarks. Have a clear understanding of what you wish to achieve. This prevents impatience from derailing your long-term strategy.

Finally, adapt to change. The market is ever-evolving, and so should your strategies. Be flexible and willing to tweak your approach based on incoming data and trends.

What is the best way to start budgeting?

Starting a budget isn’t rocket science—it’s about taking control of your finances. First, I recommend tracking your income and expenses for at least a month. This helps you understand where your money goes, which is crucial. After that, categorize your spending into needs and wants. Needs should take priority; think rent, groceries, and utilities. Once you’ve identified these, set limits for each category based on your income.

Next, create a monthly budget that reflects your financial goals. Don’t overlook savings—consider paying yourself first. Allocate a specific percentage of your income towards savings right alongside your essential expenses. Make it automatic to ensure you stay consistent. Regularly review and adjust your budget to reflect changes in income or expenses; life is unpredictable.

Remember, budgeting isn’t about restriction; it’s about empowerment. The more you budget, the more you’ll discover you can align your spending with your values. It’s a step toward achieving financial freedom and unlocking your financial potential.

How much should I save for emergencies?

I believe everyone should aim to save anywhere from three to six months’ worth of living expenses for emergencies. This isn’t a one-size-fits-all situation; your personal circumstances matter immensely. If your job is stable and your expenses are predictable, three months may suffice. However, if your income fluctuates or you have dependents, lean towards that six-month cushion. Consider factors like family obligations, job stability, and unexpected medical costs when deciding how much to save. Having this safety net grants not just financial security but immense peace of mind. Set up a separate savings account to keep this fund distinct from your everyday spending. This distinction helps you resist dipping into it for non-emergencies. Always prioritize building or maintaining this emergency fund over other financial pursuits until you feel secure. Remember, life can throw curveballs, and it’s crucial to be prepared.

What are the risks of investing?

Every investment carries risk, and it’s crucial to acknowledge this reality. Fluctuating markets can cause significant losses, and various factors—like economic shifts, interest rates, or political instability—can impact your investments unpredictably. Investing without understanding these risks is a recipe for disaster.You could face losing your principal, especially in volatile or speculative investments. Market sentiment can swing widely, leading to short-term losses that can feel overwhelming. Moreover, certain investments may offer limited liquidity, meaning you can’t access your money when you need it. It’s vital to have a clear strategy in place. Diversifying your portfolio can mitigate some risks, but it’s not foolproof. Be prepared for the unexpected—because when you invest, uncertainty is the only certainty. Ultimately, understanding and managing these risks allows you to invest more confidently and effectively toward your financial goals.

How do I choose the right investment option?

Choosing the right investment option is crucial for building wealth. Start by assessing your financial goals. Are you saving for retirement, a house, or your children’s education? Understanding your priorities helps you narrow down choices. Risk tolerance is another key factor. If you’re uncomfortable with fluctuating markets, consider conservative options like bonds or fixed deposits. On the other hand, if you’re open to risk, explore stocks or mutual funds that may offer higher returns.

Next, consider your time horizon. If you have a longer timeframe, you can afford to invest in riskier assets. Conversely, if you need liquidity soon, safer investments are preferable. Diversification is also essential; don’t put all your eggs in one basket. This strategy minimizes risk while maximizing potential returns. Finally, always keep learning. The market is constantly evolving, and staying informed about trends can guide you in making better choices.

What should I know about retirement accounts?

Retirement accounts are crucial for securing your financial future. Know that there are various types, like 401(k)s and IRAs, each with its own benefits and limitations. Early contributions can drastically affect your savings due to compound interest. Don’t procrastinate—start saving as early as possible. It’s essential to understand the tax implications of these accounts. With traditional accounts, you get a tax break now, while Roth accounts let your money grow tax-free. Always check employer match programs; they are essentially free money. Also, strategies like dollar-cost averaging can help you deal with market volatility. Implementing a diversified portfolio is wise to spread risk. Lastly, regularly reviewing and adjusting your retirement plan is necessary to stay aligned with your goals. Your future self will thank you for it.

How can I improve my credit score?

Improving your credit score is non-negotiable for achieving financial freedom. The best way to boost your score is to pay your bills on time. Late payments can drastically hurt your score. Consider setting up automatic payments or reminders to ensure you’re always on track. Keep your credit utilization below 30% by minimizing the balances on your credit cards. If possible, pay off your balance in full each month; this discipline not only uplifts your score but also saves you interest. Also, check your credit reports regularly for errors. Disputing inaccuracies can have a quick positive impact. Another key factor is the age of your credit accounts. Closing old accounts can reduce your score, so keep them open if they don’t have high fees. Finally, avoid applying for new credit too frequently; each inquiry can temporarily ding your score. A steady, measured approach is crucial. Commit to these best practices to significantly enhance your credit score over time.

I firmly believe that budgeting is the bedrock of achieving financial success. When you have a clear picture of your income and expenses, you gain control over your financial life. **Without a budget, it’s easy to lose track of spending and miss savings opportunities.** Start budgeting now to unlock your true financial potential.

Starting your savings early is a game changer. Compound interest works best over time, magnifying your wealth exponentially. I’ve seen firsthand how even small contributions can snowball into significant savings. Don’t wait; the earlier you start, the more financial freedom you’ll gain in the long run.

I firmly believe that mastering debt is the key to unlocking true financial freedom. Managing debt effectively allows us to build wealth, invest wisely, and save for future goals without the constant burden of financial strain. Don’t underestimate the power of a strong debt management strategy; it transforms your financial life.

Being aware of market trends gives us the power to make savvy choices. I can confidently assess where to invest, how to save effectively, and which budgets to prioritize. This knowledge equips me to react not just to current events, but to anticipate future opportunities. Ultimately, it strengthens my financial foundation.

I firmly believe that using financial tools can transform how we manage our money. These tools take the guesswork out of budgeting, saving, and investing. It’s time to leverage technology for better financial control. With the right resources, achieving your financial goals becomes much less daunting.

**Starting your retirement planning early is non-negotiable.** The earlier you begin, the more time you have to grow your savings and investments. **Waiting till later can cost you dearly in lost opportunities and compounding interest.** Don’t gamble with your future; take action now to secure your financial freedom.

Having an emergency fund is essential for financial stability. Life is unpredictable, and unforeseen expenses can swiftly derail your plans. Every time I tap into my emergency fund, I feel a wave of relief, knowing I’m covered. This safety net empowers me to tackle emergencies without panic, helping me maintain control over my financial journey.

**I believe that shifting our mindset is crucial for developing better financial habits.** By changing how we view money—seeing it as a tool for opportunities rather than a source of stress—we open doors to smarter saving, investing, and budgeting. **Embracing a proactive approach creates a cycle of positive financial behavior.** This shift can truly unlock our financial potential.

As an Amazon Services LLC Associates Program participant, we earn advertising fees by linking to Amazon, at no extra cost to you.